The mREITs Face Even Greater Headwinds - Avoid Them

BOOKMARK / READ LATER

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Sometimes the most difficult aspects of investing are realizing that some companies should be avoided at times of uncertainty. I read articles written on Seeking Alpha extolling the virtues of some of the most difficult stocks to hang on to in our current economic situation: the mREIT stocks, specifically Annaly Capital (NLY) and American Capital Agency (AGNC).

First of all I have owned both of these stocks myself. Annaly was a stock that I have discussed in various positive articles for quite some time and it had been very good to me at various points of my owning it. I can say the same about AGNC, but I did not own that one for as long.

The sector itself is difficult to understand when the interest rate environment is stable. When it is in a state of flux, this sector becomes a lighting rod for all that is wrong with seeking high yielding investments. The dividends look so very compelling that we just keep coming back to them, and begin making excuses and rationalizing the continuous storm clouds that make these stocks just too damn risky right now.

More Storm Clouds Are Forming

We all know about how the Fed has been tinkering with interest rates and mortgage backed securities. To say the least, we really have no idea what tomorrow will bring. Yes, a new "dove" has been selected to take over for Bernanke, but so what? Does that mean the coast is clear and it will be QE forever? Will interest rates stabilize enough for these companies to get their houses in order to continue making money to keep book values up and dividends at least the same, and not being continually cut?

The truth is that none of us really knows. These companies have no products being made, no products being sold, and they make money in the confusing world of "trading money."

Both of these companies need a stable interest rate environment, a wide spread between the 2-10 year treasuries, a solid housing market, and an increasingly strong mortgage market for these companies to turn over their "inventory".

Unfortunately none of these "needs" is currently being met.

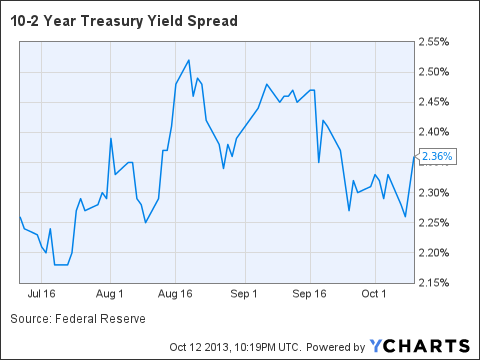

As you can see from this 3 month chart, the spread has been all over the place. This makes navigating the market very difficult for these mREITs and more concerning, unpredictable. As a result, both of these companies had to cut the dividends they pay out once again.

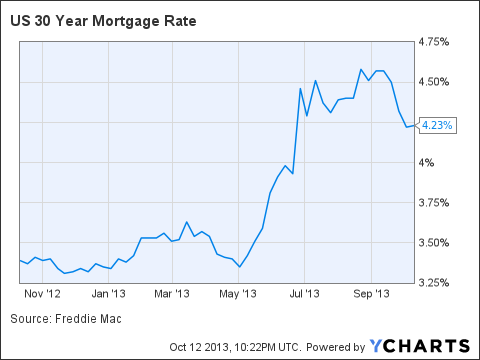

In addition to the spread, we also have this chart to look at:

US 30 Year Mortgage Rate data by YCharts

Over the last few years, the 30 year mortgage rates were very desirable for homeowners to either re-finance or actually purchase new homes. The rates led the way to the current housing recovery we have enjoyed, yet as you can see, the rates have risen to a point now where new applications are being negatively impacted.

Builder data tracked by the Mortgage Bankers Association (MBA) indicates mortgage applications for new home purchases decreased from August to September..... MBA's monthly Builder Application Survey (BAS), which uses application volume from mortgage subsidiaries of homebuilders, suggests new home purchase application volume declined 1 percent month-over-month in September

While the refinancing numbers have worked in favor of the mREITs, the market for new mortgages is now weakening, so in my opinion the mREITs will be somewhat "stuck" with existing inventories at low rates.

That means to me that these firms cannot take that much advantage of the spread yield right now, and prospects for revenue and income growth is crimped.

To add to this scenario, which is NOT the end of the world, these firms have to face this:

Regulators should boost oversight of the largest real-estate investment trusts that use borrowed money to invest in mortgage-backed securities because rising interest rates may push the firms into asset sales that destabilize markets, the International Monetary Fund said....Repercussions might roil the REITs' lenders, disrupt the $5.3 trillion market in which they invest and damage the broaderU.S. economy, according to its Global Financial Stability Report.

Of course this might never come to pass, but it also on the heels of what Federal Reserve Governor Jeremy Stein said earlier this year, with which the IMF now agrees:

The IMF joins Federal Reserve Governor Jeremy Stein and the U.S. Financial Stability Oversight Council in saying this year that the companies led by Annaly Capital Management Inc. (NLY) andAmerican Capital Agency (AGNC) Corp. pose risks to markets....."Sizable disruptions in secondary mortgage markets against a backdrop of rising mortgage rates could also have macroeconomic implications, jeopardizing the still-fragile housing recovery," according to the report....Authorities also "could consider changing the exemption status for certain" mortgage REITs, or label the largest as systemically important and in need of more oversight, the group said.

If you recall, back in 2011 the SEC asked for comments about the very same statements being made now, but nothing was ever done. In my opinion, this brings the issue to the forefront once again. With the bright lights being shown on not only the housing market, but the financial markets themselves, the issue could tighten the noose even further around the "necks" of these companies.

The question an investor needs to ask themselves is if all of this is worth placing a bet on? Yes the yields are wonderfully attractive, but in the last year or so the total returns have stripped away the dividends, with lower share prices AND dividends being cut continuously.

Do we really want to "hope" that everything settles down so that we can actually enjoy the dividends? I know that there are some investors who have been invested in NLY for 15 years. Those lucky folks have virtually a zero net cost basis after all this time. Does that mean an investor right now can look forward to that same luxury 16 years from now? To be honest, I simply do not see that happening at this point.

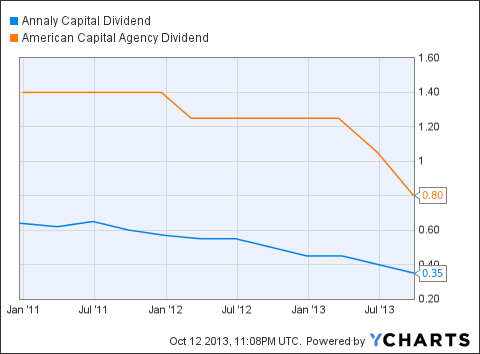

Keep in mind that there are more investors who paid much more for shares of these two stocks, while dividends have been cut:

NLY Dividend data by YCharts

For AGNC, the dividend has dropped from $1.40/share to $.80/share quarterly. The NLY dividend has been cut from $.65/share to $.35/share quarterly. The share price of AGNC has dropped roughly 33% in one year, and for NLY the drop has been about 35%.

As far as I am concerned, since 2011, these 2 stocks have not been good investments as I once thought they were.

Now that we are facing even more headwinds, I am wondering what the upside actually is that attracts so many positive articles and bullish opinions?

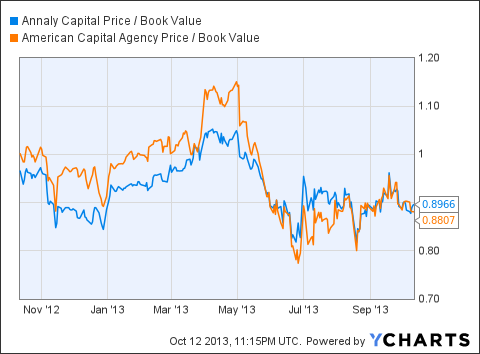

NLY Price / Book Value data by YCharts

Most of the bullish opinions seem to come from the price/book value percentage. There is no disputing that each are selling at a serious discount to book value, but what does that actually mean?

To me, the market is saying that the current share prices are not worth more than what they are selling for. What is even worse is that these stocks, facing the headwinds I described above, could be in for further share price deterioration, dividend cuts, and even greater discounts to book value.

We simply do not know, and the landscape changes almost every single day. But wait, there is more.

Tighter Credit Makes Business Even More Difficult For The mREITs

It seems to be tough enough right now for adequate profits to be made by the mREIT sector. Of course when the credit markets themselves start tightening up, business is not just difficult, but more like pulling teeth.

Mortgage lending remains tight compared to historical norms, and lending could tighten even further as the government takes steps to lessen its role in the market, according to a recent report byMoody's Analytics and the Urban Institute.....While the report concedes "underwriting does not appear overly tight in terms of debt-to-income or loan-to-value ratios," the report's authors said the credit scores required to obtain a mortgage loan today areabnormally high.....Looking ahead, the researchers say, "Some impending moves by Fannie and Freddie and possibly the FHA will tighten the credit box further."....."Reducing Fannie and Freddie's outsize role in the mortgage market is ultimately desirable, but will significantly tighten the credit box and impair the housing and economic recoveries....

This credit tightening goes directly to the heart of the mREIT business and when you combine this issue with the others I have detailed above, this sector is not one that I would embrace.

I would avoid this sector and these stocks right now.

My Opinion

I know that plenty of folks love the dividends, and I was one of them. The game seems to have changed for now and just because we might see a decent check every quarter (in the face of a depleting portfolio value, and dividend cuts themselves), why would a prudent investor, especially a retired one, consider buying these stocks right now?

Do not buy what you cannot figure out, and know when to let go and seek greener pastures.

Disclaimer: The opinions of the author is not a recommendation to either buy or sell any security. The author is NOT an mREIT expert and you should remember to do your own research prior to making any investment decisions.